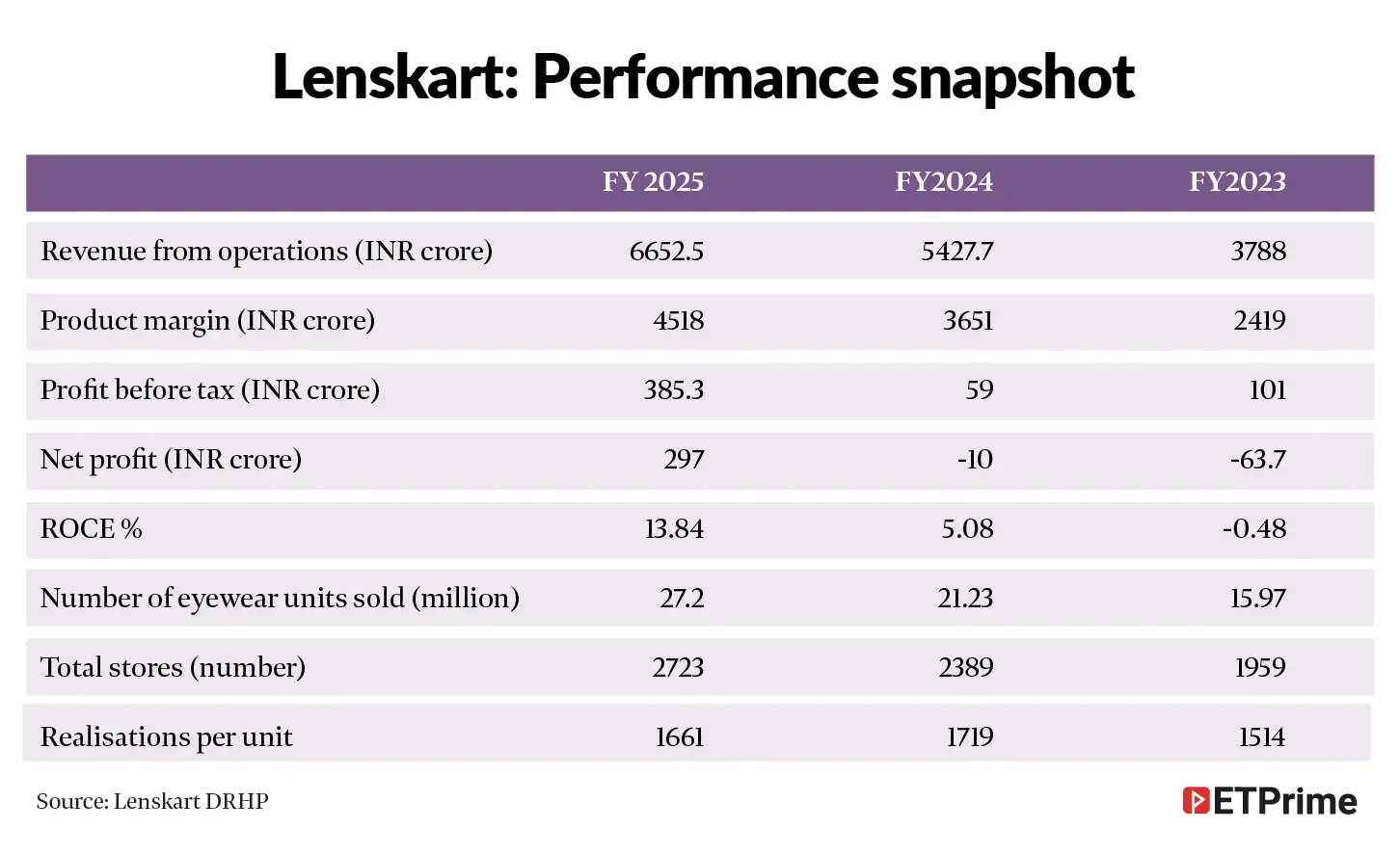

A five-year compounded annual growth rate of 60%, an uncontested leadership in the domestic market, a fast-growing international business that accounts for 40% of revenue and a 70%-plus gross margin; that should set Lenskart and its founder Peyush Bansal for a breezy entry into public markets. But its INR70,000 crore valuation is now a subject of intense public scrutiny and a heated social media debate.

This has split the investing community down the middle. Does an operationally loss-making company that posted a profit with non-operational income deserve that value, or its use of technology to grow the boring business of selling spectacles justify it? The trolls are busy as the sale opens today.

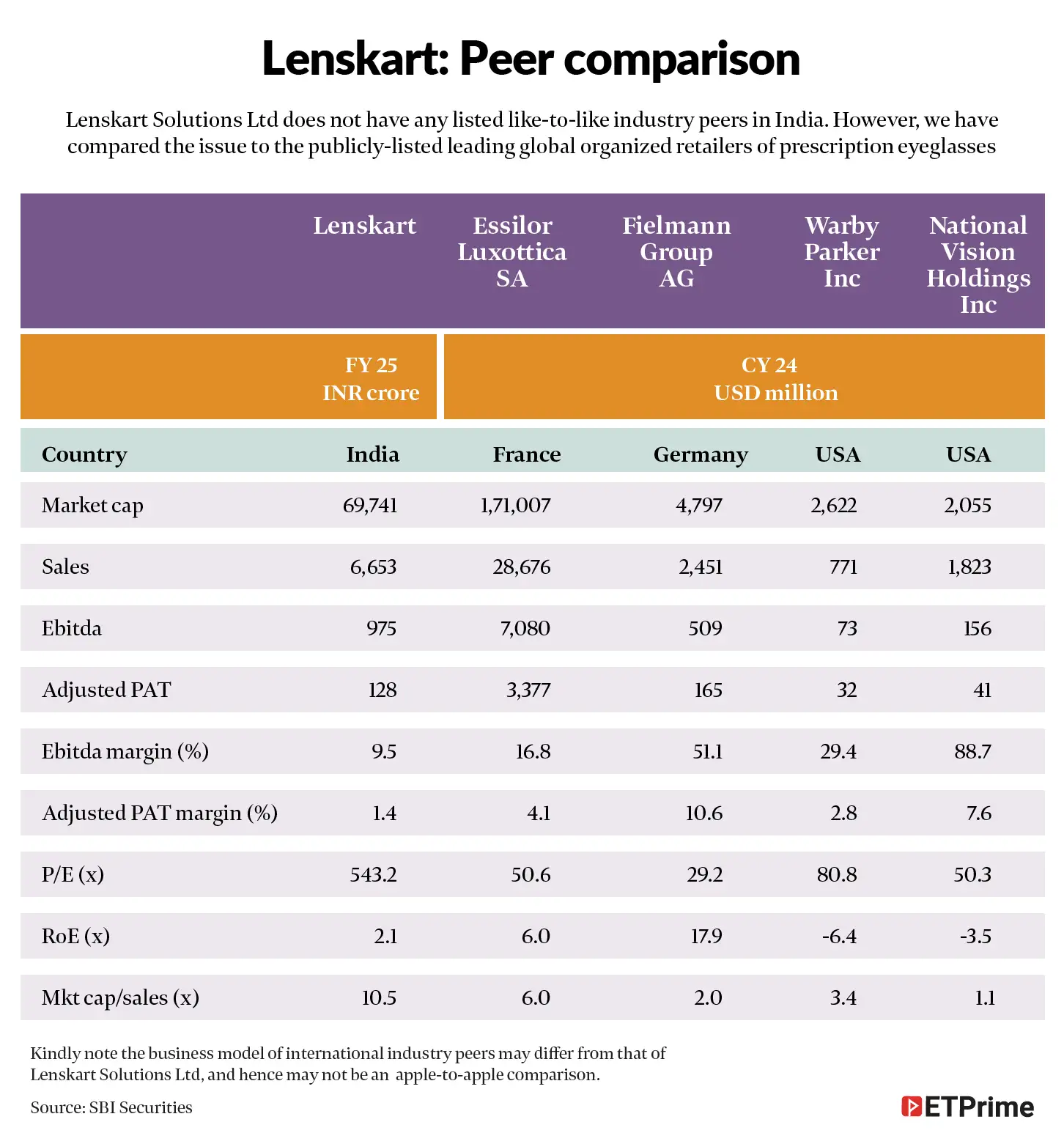

“At the upper band of INR402, the IPO is valued at FY25 EV/Sales and EV/EBITDA multiples of 10.1x and 68.7x, respectively, based on post-issue capital. Valuation of Lenskart seems to be stretched and hence listing gain is likely to be muted,” said SBI Securities in a note ahead of IPO.

In mid-2024, a secondary sales transaction at Lenskart took place at a valuation of USD5 billion. The pre-IPO funding by SBI Mutual Fund and DMart founder Radhakrishan Damani — INR100 crore and INR90 crore respectively — were at USD7.7 billion (around INR68,000 crore). The IPO valuation is INR70,000 crore.

Critics question nearly 60% jump in valuation a year. The social media rumblings do not stop there. A few other matters were under public scrutiny.

– Bansal bought Lenskart shares at USD1 billion valuation ahead of IPO and sold at 7x-8x that price at public listing.

– The company reported profits after years of net loss just ahead of IPO. The profits were propped up by non-operational income such as mutual fund gains and FD interests.

– Price-to-earnings multiple of 225x; and 10x revenue multiple for a retail stock do not convince investors.

– Whether it’s a tech company because of thousands of physical stores.

– Its international growth came by way of acquisitions.

In Lenskart’s defence:

Regarding Bansal’s purchase of shares at discounted price: This wasn’t a fresh issuance of shares but investors selling their shares to the founder. In VC-backed companies, it is not uncommon for private capital investors to reward founders with shares at preferential pricing when key business milestones are achieved, as a way to strengthen founder ownership ahead of listing.

Unlike many of its new economy peers, Lenskart always reported negligible losses while growing at a high pace.

The tech-driven businesses usually command this valuation for the high margin and growth.

Its India-centred manufacturing and tech-led retail operation should fuel its overseas sales.

The opinion is divided.

Bansal’s response that he was focused on value creation and not valuation hasn’t helped either. His bankers defended the IPO pricing by saying it is benchmarked against its listed peers in the consumer tech space in India.

Lenskart reported a 22% growth at INR7,009 crore revenue and INR280 crore profit. One of the consumer internet peers that the bankers mentioned was Nykaa, which started as online retailer of lipsticks and perfumes. Nykaa reported INR7950 crore revenue and INR72 crore profit and a growth rate of 24%. Nykaa has a market cap of about INR73,000 crore. Lenskart targets similar valuation. Their Q1 financials are comparable too.

But Lenskart is not necessarily viewed as a consumer internet stock.

“Lenskart is a manufacturer-cum-retailer. Hence Ebitda is not the correct parameter to judge profitability,’’ says Geetanjali Kedia of SP Tulsian Investment Advisor. “Profit before tax less other income as a percentage of revenue stood at 3% in Q1 FY26. At this scale, a low single-digit profit margin is not impressive and does not justify the IPO price,” she says.

The company’s addressable market may be big, and its revenues are growing, but the profitability – a key element for premium equity valuations – is falling. The realisation of Lenskart eyeware works out to INR1,600 for FY2025 which is lower than FY2024 at INR1,700.

While nearly three dozen new age businesses have listed, it is the first time a direct-to-customer eyewear maker is entering the public market. How are the listed eyewear companies in other markets valued?

The Franco-Italian vertically integrated eyewear giant EssilorLuxotica has a market cap of around USD170 billion. Its revenue was around USD29 billion. A revenue multiple of 6x and estimated P/E ratio of 50x-60x. German eyewear retailer Fielmann AG with a revenue of USD2.5 billion is modestly valued at around USD5.3 billion. In comparison, Lenskart would be the most expensive eyewear stock in the world.

However, both the above-mentioned companies operate in matured markets and experience relatively slower growth compared to Lenskart. Their business models are different from that of the Indian eyewear unicorn. Lenskart is the top player in India, Southeast Asia and Middle East. Bankers are quick to point to the pre-IPO interest and the anchor placement.

Companies preparing for public listings often highlight what they describe as unique or differentiated business models to justify higher valuations. In many cases, these models may indeed be innovative, while in others they are traditional businesses done more efficiently with new technologies.

Companies from Zomato to Paytm and Mamaearth to Ola Electric were subject to public scrutiny for their business models and valuation at the time of IPO. Investors have had a rough ride with many of them as numbers post the listing revealed a different story than that was peddled during roadshows. Investors kicking up dust is set to impact the intensity of the demand, though the result will be known Tuesday.

https://economictimes.indiatimes.com/prime/money-and-markets/how-will-online-rage-over-lenskart-ipo-valuation-affect-bids/primearticleshow/124952316.cms